A Cash Receipt is a printed statement of the amount of cash received in a cash sale transaction from a customer or an investor. It is used to report transactions in writing form. Some companies sell products and services on credit and expect cash payment after a certain period, and some require immediate cash payment for their goods or services.

In both cases, the company has to provide a receipt for cash payment to their clients as confirmation of receiving the payment for their goods or service rendered. A seller should provide this receipt for every product or service purchased from their business. The services for which a Cash Receipt can be provided may be the following: renting out equipment or building, or interest received on investments.

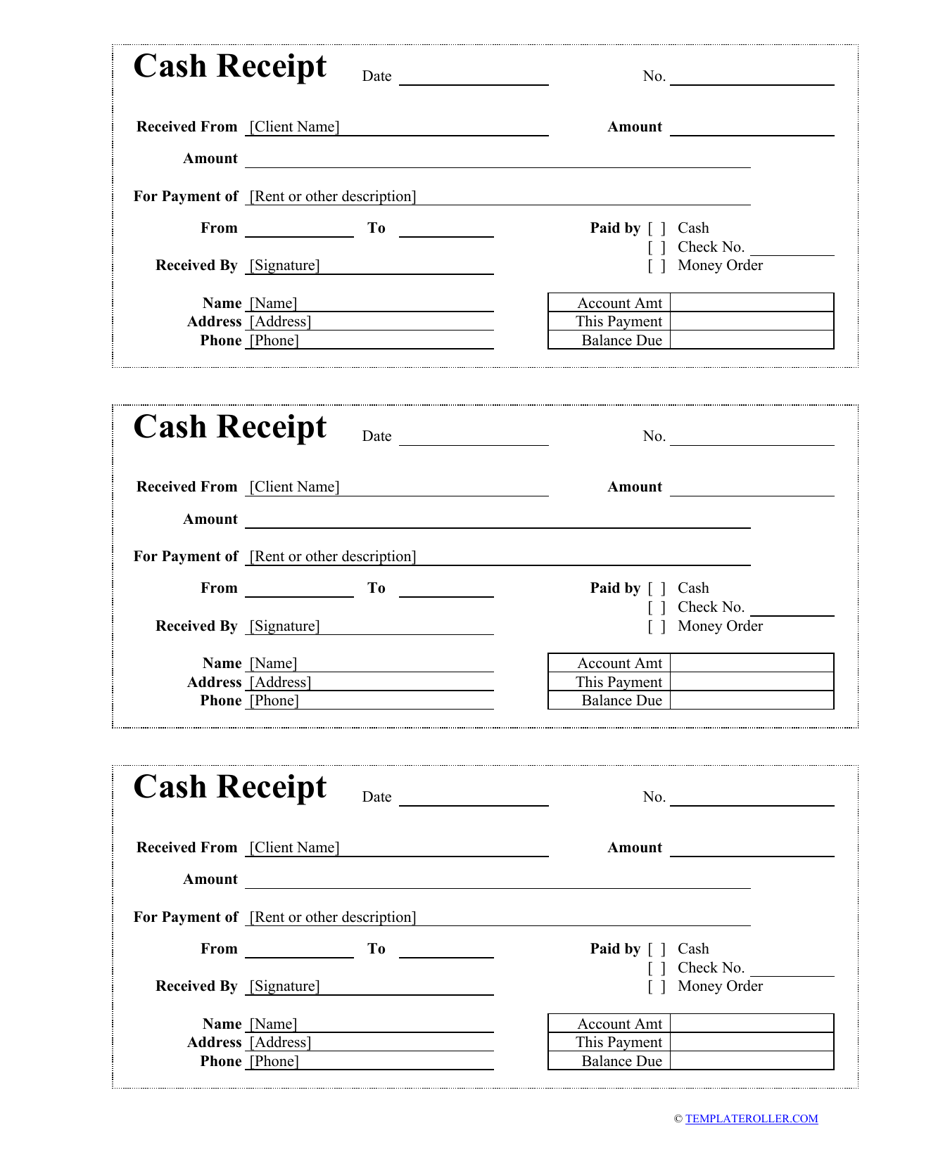

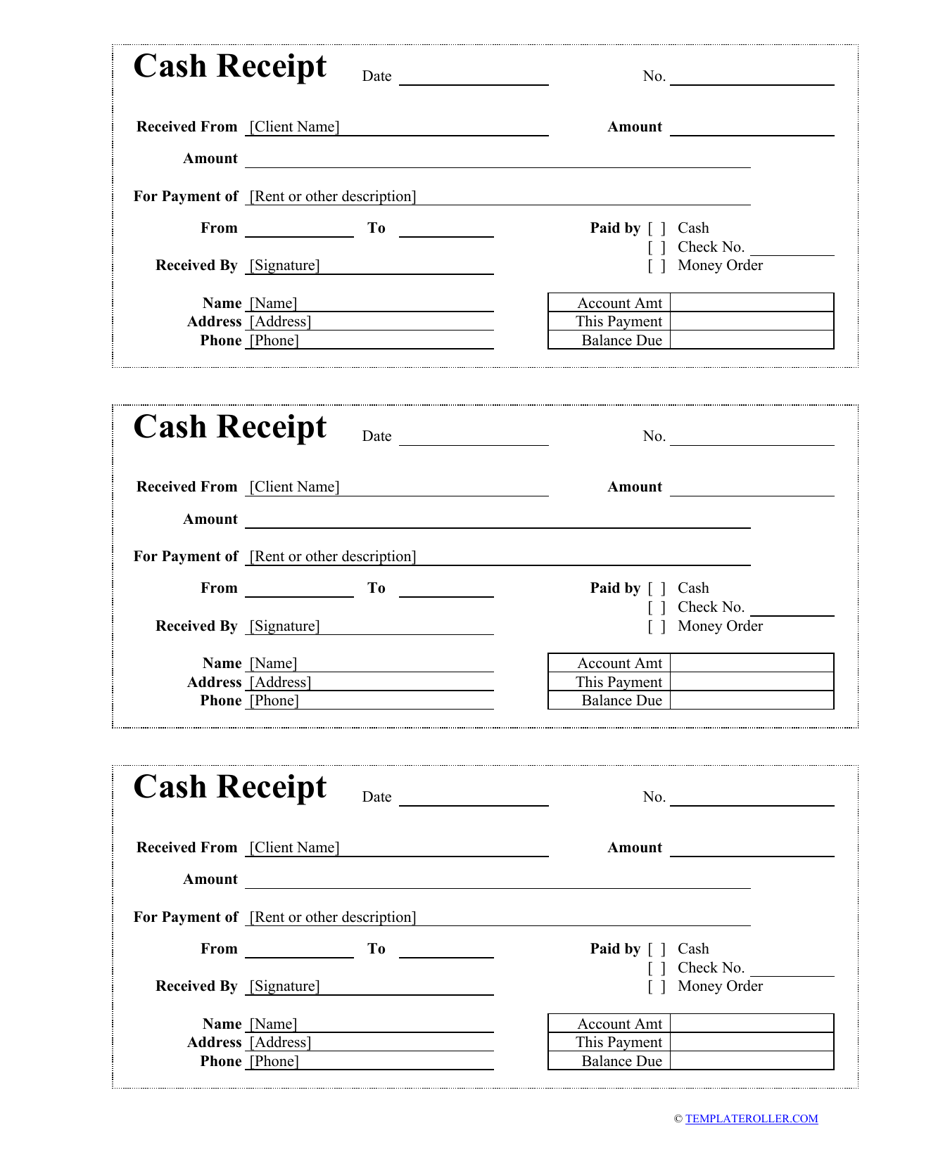

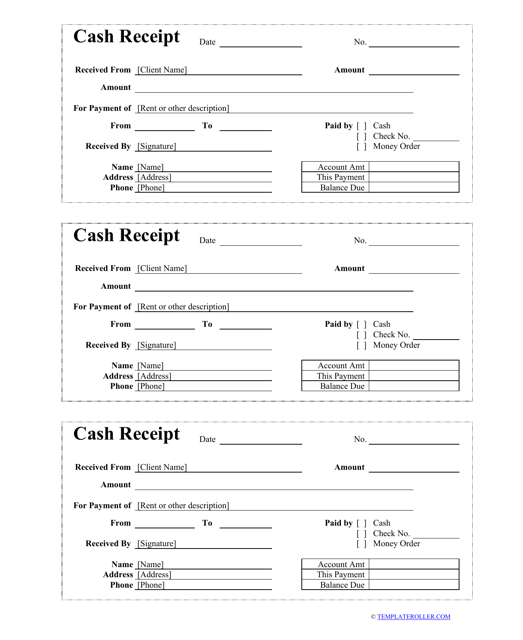

A printable Cash Receipt template can be downloaded through the link below.

ADVERTISEMENTA Cash Receipt should include the following:

The seller should approve a Cash Receipt Form for their company and issue every receipt following the established template. A Cash Payment Receipt has to be provided to a purchaser, and a copy of it should be retained in the company for accounting purposes. A Receipt for Cash Payment must be recorded as an increase to the cash account and is used by the seller to track their sales and goods sold, calculate and estimate their income. The purchaser should keep the Cash Receipt as proof of purchase.

Companies or individuals may use a hand-written receipt when they perform their transactions without a terminal or cash register. When a payment is paid in cash, a Cash Receipt is the only proof of this payment so the receipt acts as a legal document that a buyer can use to establish their ownership of a purchased item or service. This kind of receipt can also be provided to purchasers of different products if it is set by the tax deduction rules.

Haven't found the template you're looking for? Take a look at the related templates below:

Cash Transaction Cash Payment Cash Receipt Template Sales Performance Receipt Template Sales Strategy General Business Forms Business

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.