By Sophie Perret , Nikola Miljković

Amsterdam is in the province of North Holland, in the heart of the Randstad, Europe’s sixth-largest metropolitan area. The city of Amsterdam is the capital and the largest city in the Netherlands, with a population of just over 900,000 recorded in 2021. While Amsterdam is known globally for its historic canals, art museums (Rijksmuseum, Van Gogh Museum), red-light district and ‘coffee’ shops, it is also a significant European financial and business centre. More than 2,000 foreign companies have established offices in the metropolitan area, and more than 200 of these companies have headquarters in the city. Following Brexit, Amsterdam benefited from an inflow of new businesses, with 133 international offices opening up in 2021 (including 32 headquarters). The city is highly accessible, with well-developed local, national and international transport links, including Amsterdam Schiphol Airport, the European high-speed rail network and the North Sea Canal.

Sources: HVS Research; 2020 RAI Amsterdam Annual Report

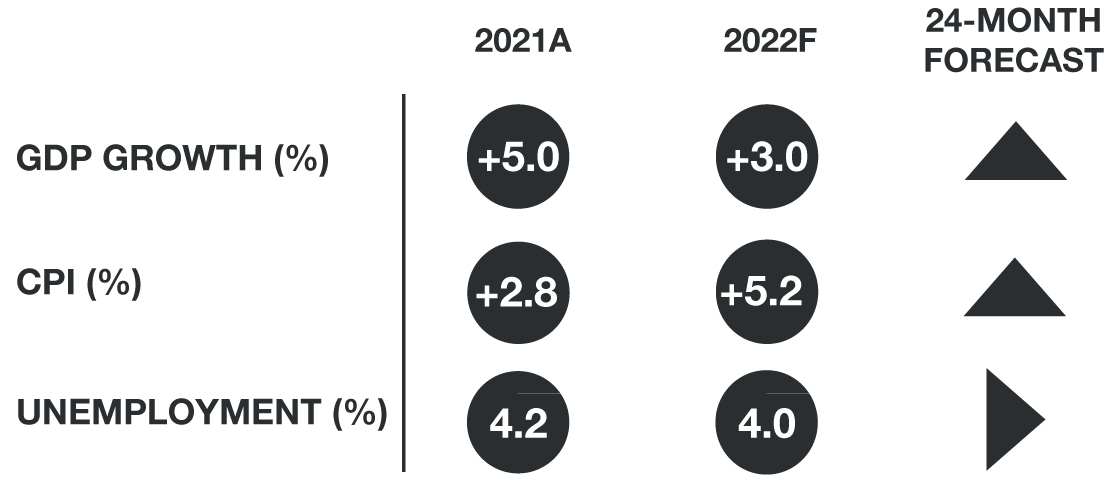

Economic Indicators – The Netherlands

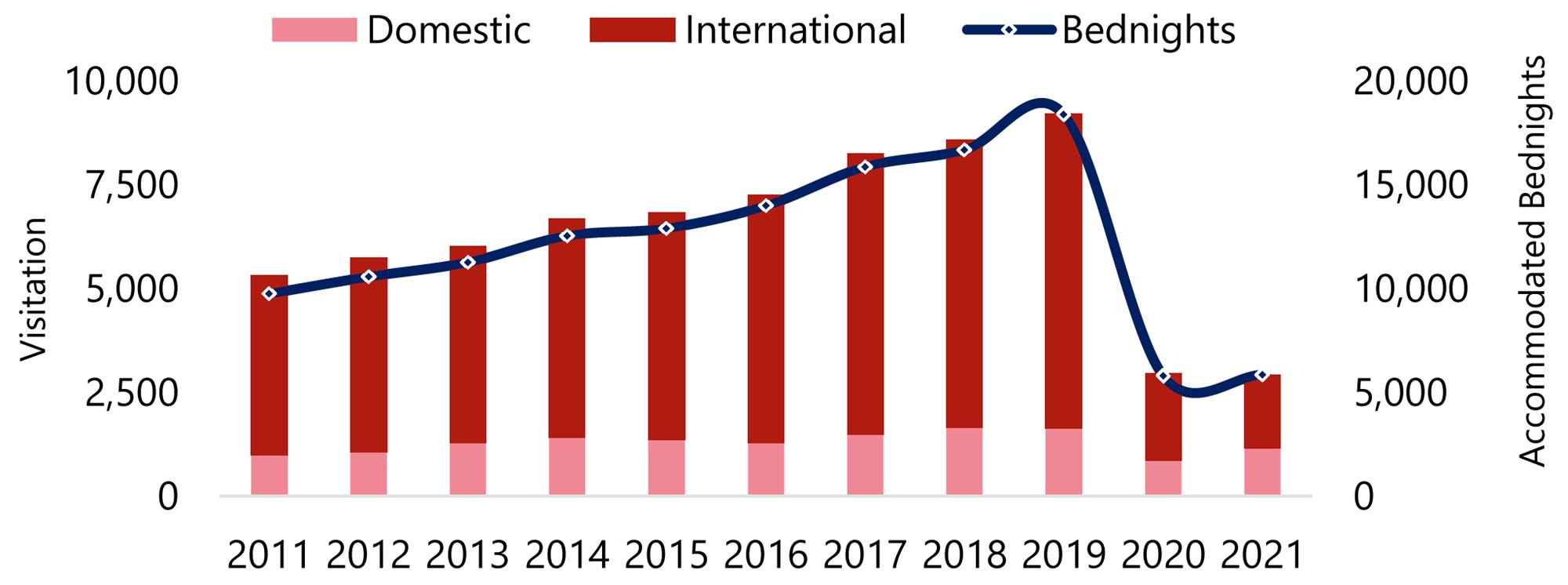

Visitation to Amsterdam grew at a compound annual growth rate of 6.4% from 2010 to 2019, with international visitation leading the growth (6.8% CAGR 2010-19). The main international feeder markets in 2019 were the UK (15.5%), the USA (11.1%), Germany (10.1%) and France (5.2%), while the domestic market accounted for 17.8% of the total visitation. In 2020, visitation was impacted by the COVID-19 pandemic, resulting in a 70% decrease compared to a record high in 2019. Visitation in 2021 was broadly stable compared to 2020, with some signs of recovery from the domestic market and neighbouring countries (Belgium and France). Owing to strict cross-border restrictions, demand from the UK experienced a further decline of 74% in 2021, compared to 2020 levels, resulting in only 3% of the total visitation to Amsterdam that year. Following the lifting of restrictions in March 2022, visitation to Amsterdam rebounded strongly. Year-to-May data for 2022 indicates strong growth compared to year-to-May 2021 with visitation almost quadrupling, but still some 40% below year-to-May 2019 levels.

Visitation and Accommodated Bednights – The Netherlands (000s)

Sources: TourMIS, April 2022

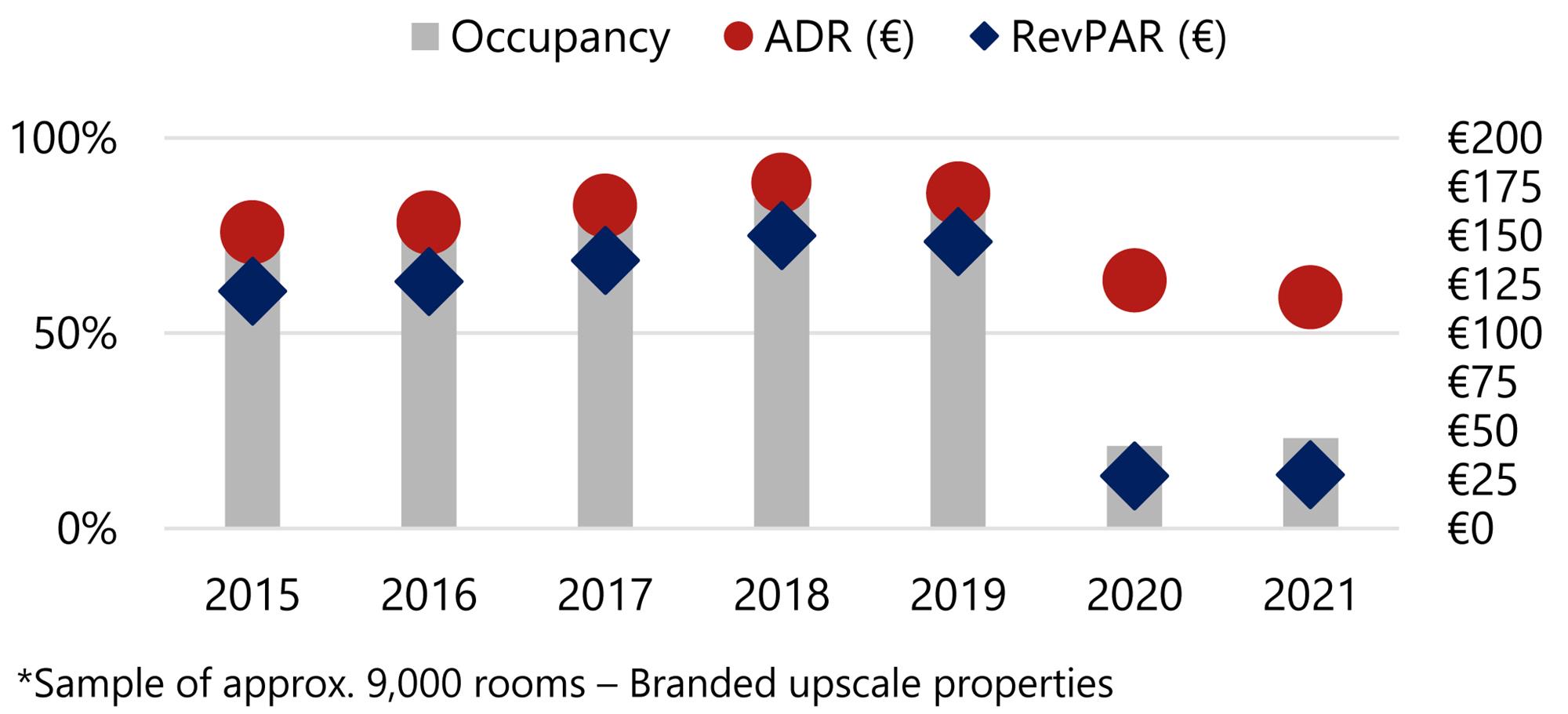

Key Metrics

Source: HVS Research

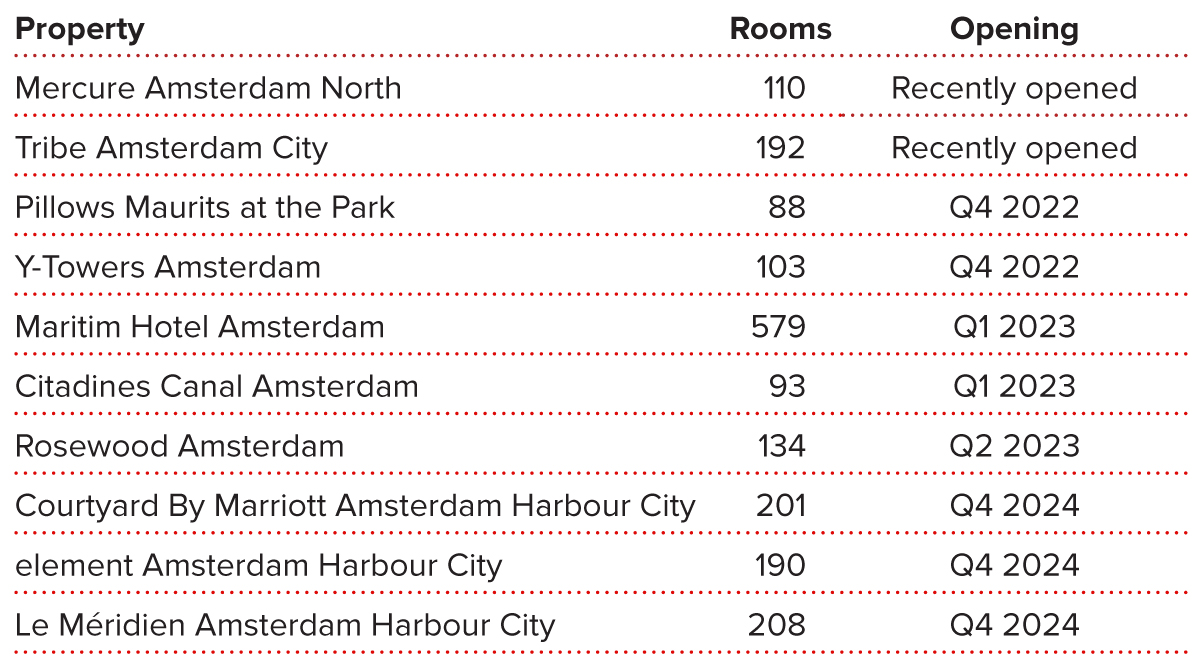

Overall, hotel supply increased at a compound annual rate of 4.7% from 2010 to 2020, with around 2,000 new rooms recorded in 2018. Total hotel supply currently stands at around 39,000 rooms, and it is fairly equally distributed across the Upscale category (27.4%), the Upper Midscale category (23.7%) and the Upper Upscale category (22.6%). The largest average growth (CAGR 2010-22) was recorded in the Upper Midscale class, at 6.3% or around 5,000 rooms.

The ban that was placed on new hotel developments in the Canal District in 2015 resulted in planned projects moving out to more fringe areas. However, at the end of 2016, the city of Amsterdam implemented further restrictions on new hotel construction in order to better manage tourism flow within the city. These restrictions essentially prohibit the development of hotels except in designated areas (such as Overhoeks, Buiksloterham and Indische Buurt) for which development applications can be submitted. This has had a substantial impact on the future hotel pipeline.

Hotel Pipeline

Source: HVS Research

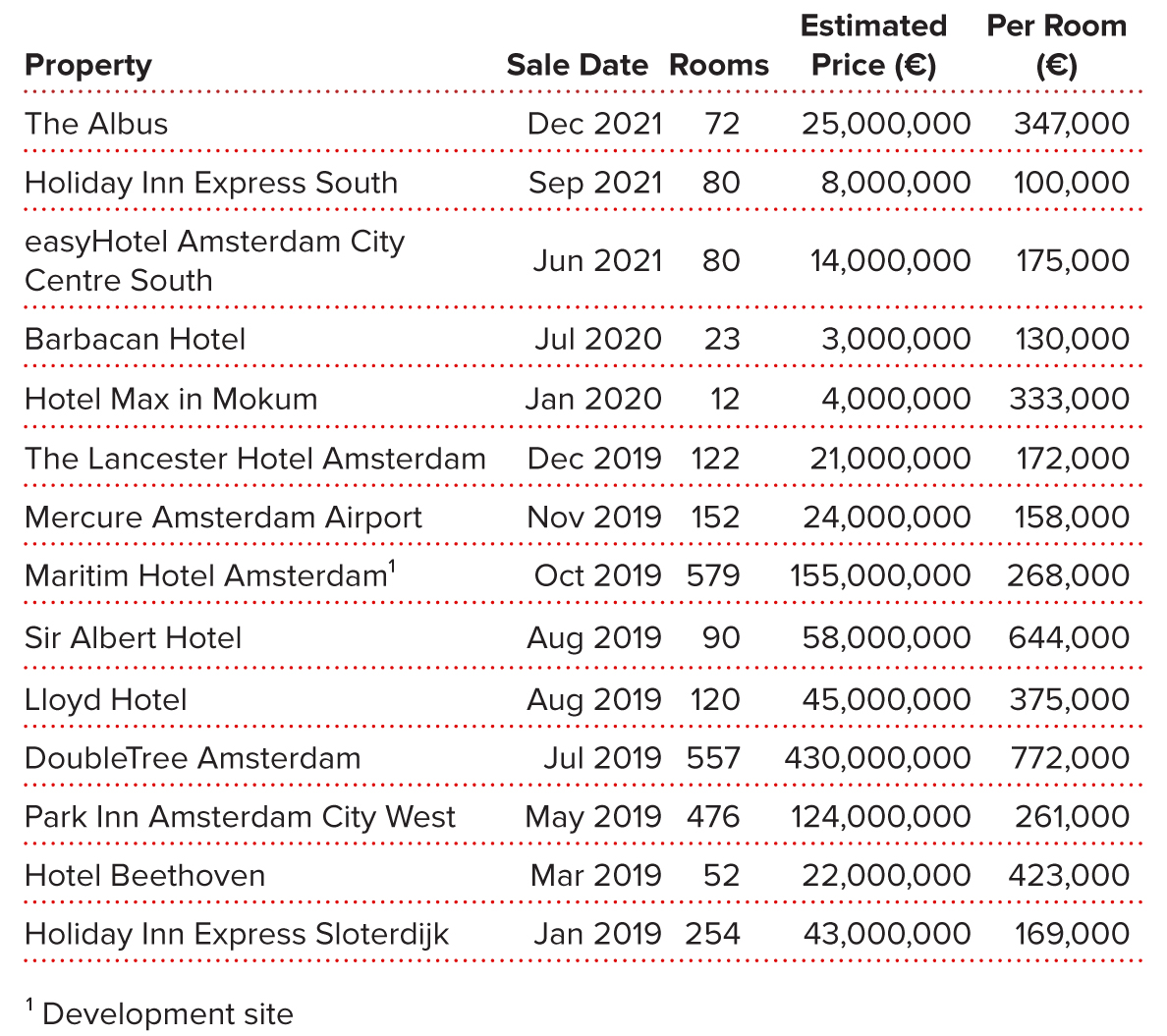

Amsterdam’s hotel investment market was, pre-pandemic, one of the most liquid and attractive in Europe with a substantial number of transactions happening in recent years. Key sales from 2019 onwards included the 557-room DoubleTree Amsterdam for approximately €430,000,000 (€770,000/per room) by Anbang Insurance to AXA IM – Real Assets, the 90-room Sir Albert hotel for around €58,000,000 (€645,000 per room) by Sircle Collection to WestInvest, and the 579-room Maritim Hotel Amsterdam forward sale for €155,000,000 (€268,000 per room) by Invester United Benefits and IES Immobilien to Union Investment. Compared to the strong activity in 2019, only two transactions took place in the whole of 2020, and a further three in 2021, of which the largest was the sale of The Albus hotel (72 rooms) for approximately €25,000,000 or around €350,000 per room by Hilver-Heuvel to Vischjager Vastgoed BV. For the latest value trends, please refer to our annual European Hotel Valuation Index (HVI), which showcases the year-on-year value growth of hotel assets in key markets, including Amsterdam.

Hotel Transactions

Source: HVS Research

The Amsterdam hotel market was strongly impacted by government restrictions imposed during the pandemic, which resulted in particularly weak performances for this market in 2020 and 2021. However, data to the end of June 2022 portray the enduring appeal of this market for both its leisure and corporate demand bases. We expect the post-pandemic recovery to continue to benefit from the limited new supply allowed in the market. This, coupled with the strong fundamentals of this market and generally well-diversified demand sources, should allow Amsterdam to quickly recovery its position as one of Europe’s more coveted hotel markets. As indicated in our European Hotel Valuation Index, hotel values have already started to recover in 2021, and remain amongst the highest in Europe.

Value Trends

Sophie Perret is managing director of the HVS London office. She joined HVS in 2003, following ten years’ operational experience in the hospitality industry in South America and Europe. Originally from Buenos Aires, Argentina, Sophie holds a degree in Hotel Management from Ateneo de Estudios Terciarios, and an MBA from IMHI (Essec Business School, France and Cornell University, USA). Since joining HVS, she has advised on hotel investment projects and related assignments throughout the EMEA region, and is responsible for the development of HVS's business in France and the French-speaking countries. Sophie completed an MSc in Real Estate Investment and Finance at Reading University in 2014. Sophie is also a certified surveyor and a member of the RICS. For further information, please contact: [email protected] or +44 20 7878-7722 (Work)