TaxEDU Glossary

Understand the terms of the tax debate with our comprehensive tax glossary, including over 100 tax terms and concepts.

Featured Terms

Internal Revenue Service (IRS)

Inflation

Sales Tax

Related Terms

Refine Results

115 Results

Adjusted Gross Income (AGI)

After-Tax Income

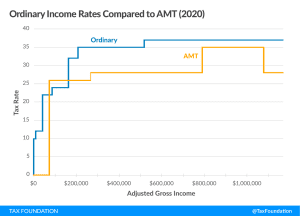

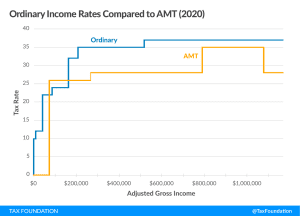

Alternative Minimum Tax (AMT)

Apportionment

compliance costs and tax enforcement tax gap discussion IRS commissioner" width="300" height="200" />

compliance costs and tax enforcement tax gap discussion IRS commissioner" width="300" height="200" />

Audit

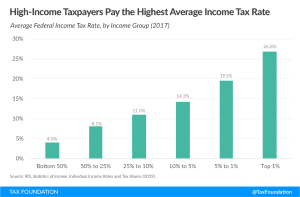

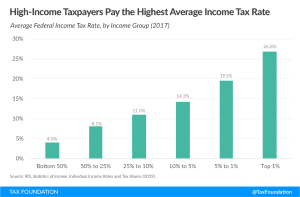

Average Tax Rate

Base Broadening

Base Erosion and Anti-Abuse Tax (BEAT)

Bonus Depreciation

Book Income

Bracket Creep

C Corporation (C corp)

Cadillac Tax

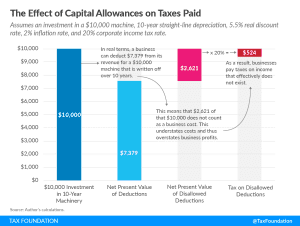

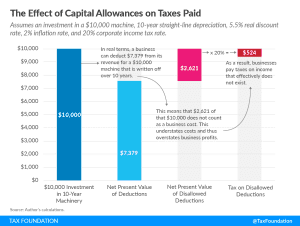

Capital Allowance

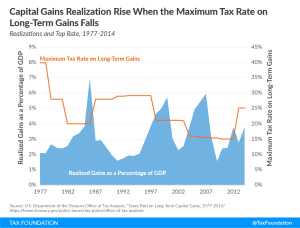

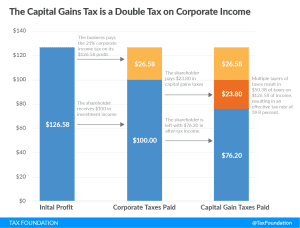

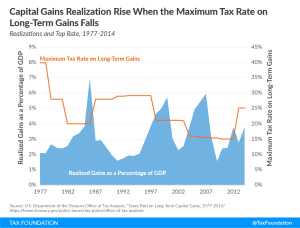

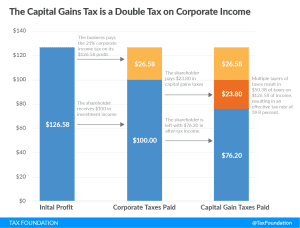

Capital Gains Tax

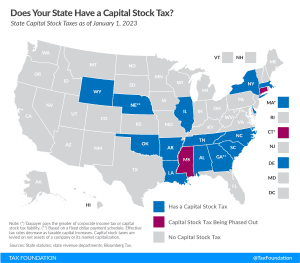

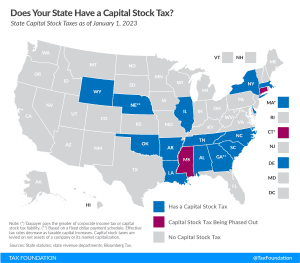

Capital Stock Tax (Franchise Tax)

and gas companies Carbon Tax definition, Carbon Emissions, CO2 Emissions, Global Temperatures, Climate Change, AOC, Ocasio-Cortez, Green New Deal, energy, environomental, payroll tax cut" width="300" height="195" />

and gas companies Carbon Tax definition, Carbon Emissions, CO2 Emissions, Global Temperatures, Climate Change, AOC, Ocasio-Cortez, Green New Deal, energy, environomental, payroll tax cut" width="300" height="195" />

Carbon Tax

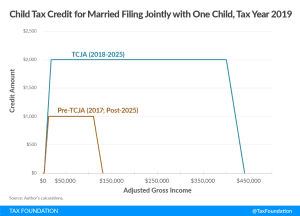

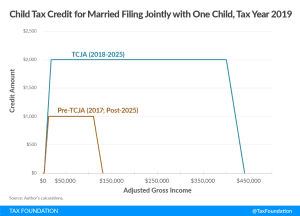

Child Tax Credit (CTC)

Congressional Budget Office (CBO)

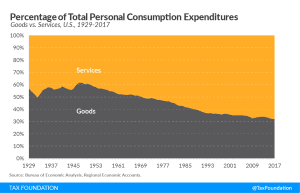

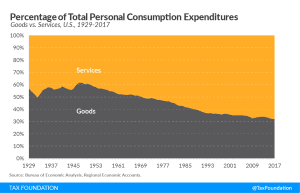

Consumption Tax

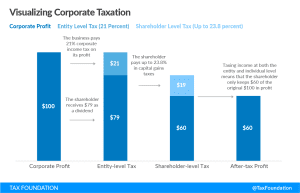

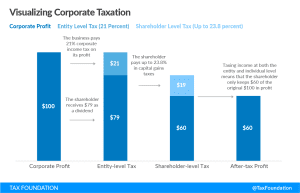

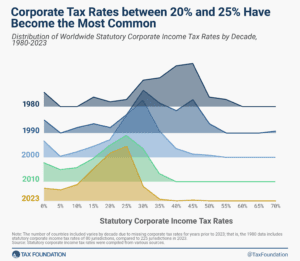

Corporate Income Tax

Cost Recovery

Depreciation

Direct Tax

Distributed Profits Tax

Double Taxation

Dynamic Scoring

Earned Income Tax Credit (EITC)

Emissions Trading System (ETS)

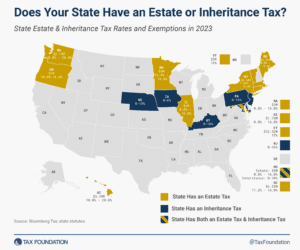

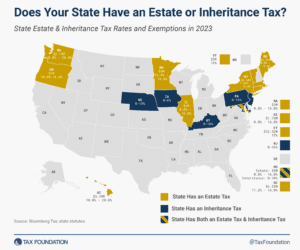

Estate Tax

Excise Tax

Externality

Financial Transaction Tax (FTT)

Flat Tax

Foreign Direct Investment (FDI)

Foreign-Derived Intangible Income (FDII)

Full Expensing

Gas Tax

Gift Tax

Global Intangible Low-Taxed Income (GILTI)

Graduated Rate Income Tax

Gross Income

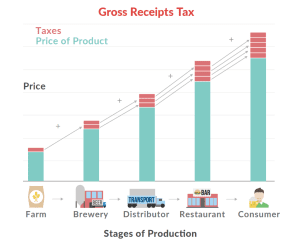

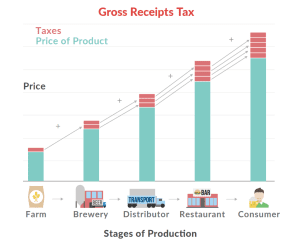

Gross Receipts Tax

Head Tax

business equipment depreciation schedules" width="300" height="200" />

business equipment depreciation schedules" width="300" height="200" />

Indirect Tax

Individual Income Tax

Inflation

Inflation Indexing

Inheritance Tax

Internal Revenue Service (IRS)

Page 1 of 3 1 23

Stay informed on the tax policies impacting you.

About

Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy in the U.S. and internationally. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

Donate

As a nonprofit, we depend on the generosity of individuals like you.

1325 G St NW, Suite 950

Washington, DC 20005

- Copyright Tax Foundation 2024

- Copyright Notice

- Privacy Policy

compliance costs and tax enforcement tax gap discussion IRS commissioner" width="300" height="200" />

compliance costs and tax enforcement tax gap discussion IRS commissioner" width="300" height="200" />

and gas companies Carbon Tax definition, Carbon Emissions, CO2 Emissions, Global Temperatures, Climate Change, AOC, Ocasio-Cortez, Green New Deal, energy, environomental, payroll tax cut" width="300" height="195" />

and gas companies Carbon Tax definition, Carbon Emissions, CO2 Emissions, Global Temperatures, Climate Change, AOC, Ocasio-Cortez, Green New Deal, energy, environomental, payroll tax cut" width="300" height="195" />

business equipment depreciation schedules" width="300" height="200" />

business equipment depreciation schedules" width="300" height="200" />